The St. George real estate market is at a key point in 2024. It offers great chances for buyers and investors. This market in southwestern Utah is growing fast, attracting many with its housing and investment opportunities.

St. George is a beautiful place in southwestern Utah. It’s becoming a top choice for those looking for a home and a good investment. The local market is strong and growing, showing Utah’s housing market is evolving.

Those interested in the St. George real estate market will find 2024 interesting. Home prices went up about 6% in 2023 and are expected to keep growing. This makes the market both challenging and full of chances.

Key Takeaways

- St. George real estate market shows promise for growth in 2024

- Home prices have gone up about 6% in the last year

- Low inventory levels are expected to last through 2024

- Slow drop in interest rates might boost buyer interest

- The market is shaped by retirees and new businesses

- Median home prices show a stable yet changing market

Current Market Overview and Price Trends

The St. George housing market is changing fast in 2024. New trends are showing a shift in real estate. Buyers and investors need to pay close attention to these changes.

Median Home Prices and Market Statistics

St. George property values have seen big changes recently. Here are some key points:

- Median home prices hit $524,000 in 2024

- Over 2,200 homes for sale in October 2024

- Inventory levels are the highest they’ve been in 12 years

Price Changes From December 2023

The local real estate market has seen price changes. Here’s what the data shows:

| Period | Median Price | Change |

| August 2024 | $529,000 | 3% decrease from July |

| Original List Price | $549,000 | Slight adjustment |

Price per Square Foot Analysis

Looking at price per square foot can give deeper insights. Strategic pricing is key in this changing market.

The St. George real estate market shows resilience with smart pricing drawing in buyers.

Market conditions are cautiously optimistic for both buyers and sellers. With stable inventory and interest rates around 6%, there are chances for those who know the market well.

Seasonal Market Shifts and Buyer Activity

The St. George real estate market forecast for 2024 shows interesting seasonal changes. These changes are important for both buyers and sellers to know. As autumn comes, the local market trends show shifts in buyer activity and performance.

Key seasonal observations for the St. George market include:

- Homes are spending an average of 65 days on the market in August 2024

- Active listings have increased by 17.8% compared to the previous year

- Sellers are receiving 95.4% of their original list price at closing

Buyer behavior during seasonal transitions demonstrates interesting patterns in the St. George real estate market trends. The current market shows resilience, with total pending contracts rising 9.2% compared to the same period last year.

“The seasonal shifts in St. George’s real estate market reflect broader economic dynamics and local buyer preferences,” says local real estate expert.

Inventory levels are gradually expanding, with 4.4 months of available homes. This is a slight increase from previous months. It suggests a softening of the tight housing market. This could open up more opportunities for buyers looking for their ideal property in St. George.

Investors and homebuyers should watch these seasonal market trends closely. They offer key insights into buying strategies and market expectations for the St. George Market Forecast 2024.

Impact of Interest Rates on Market Dynamics

The St. George economic outlook shows a complex mix of mortgage rates and housing market trends. Interest rates are key in guiding buyer choices and market performance in Utah.

Current Mortgage Rate Trends

Recent data shows big changes in the mortgage world. The Federal Reserve expects three rate cuts in 2024. Currently, there’s a 60% chance of a June rate cut. This change could bring both chances and hurdles for homebuyers in St. George.

- Mortgage rates expected to stabilize between 5.5% – 6.5%

- Homeowners with 3% mortgages remain hesitant to sell

- National forecast suggests a marginal 0.2% decrease in home values

Federal Reserve Policy Effects

The February PCE index showed a 2.5% year-over-year increase. This could lead to monetary policy changes. These changes affect the St. George real estate market, impacting buyer affordability and investment plans.

Buyer Affordability Factors

Buyer affordability is a big deal. Current inventory levels in Southern Utah around 4 months suggest a slightly constrained market. The job market is strong, with 275,000 new jobs in February. This could boost housing demand.

The real estate market continues to adapt to changing economic conditions, opening up unique opportunities for savvy buyers and investors.

Potential buyers should look closely at their finances. They should consider the changing interest rates and local market conditions in St. George.

St. George Market Forecast 2024

The St. George Market Forecast 2024 shows a mix of challenges and opportunities. Despite tough times in the housing market, experts see slow growth and chances for smart deals. This is true for both those buying and selling homes.

“The St. George real estate market continues to demonstrate resilience in a dynamic economic environment,” says local market analysts.

Here are some key points for 2024:

- Home values are expected to rise by 6% in the year.

- Existing home sales might drop to 4.05 million.

- Low inventory will keep home prices high.

Several factors will shape St. George’s real estate future:

- Lower interest rates could help.

- There’s a lot of demand from buyers.

- More retirees and businesses are moving in.

Even with high mortgage rates, the St. George market looks hopeful. There’s been an 18% rise in active listings, showing the market might be more open. About 22.4% of listings saw price changes, opening doors for smart buyers.

Investors and homebuyers need to watch market trends closely. They should be ready to adjust their strategies in the St. George real estate scene.

Property Inventory Analysis

The St. George housing market is changing fast in January 2025. It offers many chances for real estate investment. The number of homes available has changed a lot, giving insights for buyers and investors.

Available Homes by Bedroom Count

The local market shows interesting changes in different property types:

| Bedroom Count | Number of Homes | Inventory Change |

|---|---|---|

| 1 Bedroom | 7 | 0.0% |

| 2 Bedrooms | 49 | +32.4% |

| 3 Bedrooms | 122 | +41.9% |

| 4 Bedrooms | 98 | +58.1% |

| 5+ Bedrooms | 80 | +19.4% |

New Construction Impact

The number of homes for sale went up to 356, a 37.5% increase from December 2024. 4-bedroom homes saw the biggest increase. This shows great chances for real estate investors.

Supply and Demand Balance

The market is balanced between supply and demand. Homes are listed for 95 days on average, down 1.5% from last month. This makes St. George a good place for investment.

“The diverse inventory across bedroom types presents unique opportunities for both first-time homebuyers and seasoned investors.” – Local Real Estate Expert

Average Days on Market Trends

The St. George housing market analysis shows important insights into how properties move. Recent data shows the median days on market has gone up to 79.5 days. This indicates a slight change in the real estate market trends.

Key metrics highlight the current market landscape:

- Median Days on Market: 79.5 days (+10.5 days from previous month)

- Active Listing Count: 1,474 (6.59% decrease month-over-month)

- New Listing Count: 284 (26.04% reduction from previous period)

- Pending Listing Count: 466 (13.15% decline)

These numbers show a market where properties are selling a bit slower. The increasing days on market could signal opportunities for strategic buyers and sellers.

“Market velocity is a critical indicator of underlying economic conditions and buyer sentiment.” – Real Estate Analyst

Interestingly, the market’s supply and demand scores show interesting dynamics:

| Market Indicator | Current Score |

|---|---|

| Market Hotness Score | 18.2 |

| Supply Score | 16.05 |

| Demand Score | 20.40 |

Buyers and sellers in St. George should watch these changing market trends closely. The slight increase in days on market suggests a cooling of the previously hot real estate market.

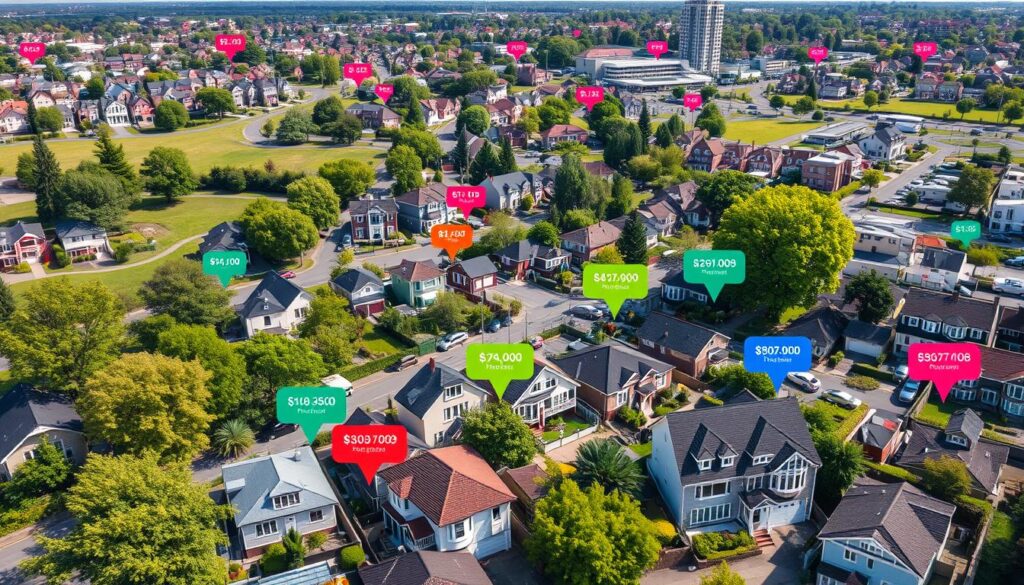

Neighborhood Price Comparisons

St. George’s real estate market is full of different investment chances in various areas. The city’s property values show a lively market with special traits in each part of Washington County.

Washington County Area Statistics

Recent data gives us key insights into St. George’s property values. Home prices have grown a lot, going from about $220,000 in 2012 to $524,000 in 2024.

| Property Size | Median List Price | Price Change |

|---|---|---|

| 1 Bedroom | $310,000 | 0% |

| 2 Bedrooms | $331,900 | +0.6% |

| 3 Bedrooms | $469,900 | -0.5% |

| 4 Bedrooms | $649,900 | -1.9% |

| 5+ Bedrooms | $915,400 | -1.6% |

Popular Subdivisions Performance

Investors looking into real estate should check these neighborhood trends:

- Over 2,200 active listings available

- Median list price in December 2024: $568,987

- Average sale price: $730,000

- Median days on market: 12 days

Investment Hotspots

St. George is a great place for investment with strong market numbers. It ranked #6 in top markets ready to bounce back, with a 121.18% total home appreciation in the last decade.

St. George’s real estate market offers strategic investment opportunities with consistent growth.

Potential investors should look closely at neighborhood-specific data to make the most of their real estate investments in St. George.

Buyer Demographics and Preferences

The St. George housing market is changing fast. Young professionals and families are moving here. They want affordable homes and a great quality of life.

Key buyer demographic characteristics include:

- Age range mainly between 30-45 years old

- Median household income of $75,000-$95,000

- Strong preference for single-family homes

- Growing interest in energy-efficient properties

“St. George offers a unique blend of affordability and lifestyle that attracts diverse buyers,” says local real estate expert.

Market trends are shifting. Remote work flexibility lets buyers choose Southern Utah. They move from expensive cities to here.

| Buyer Preference Category | Percentage of Market |

|---|---|

| Single-Family Homes | 62% |

| Townhouses | 22% |

| Condominiums | 16% |

The St. George housing market is growing. Buyers are looking for value, lifestyle, and investment in this area.

Economic Factors Affecting the Market

The St. George economic outlook shows a mix of growth and new chances for real estate. Economic changes are making the local property scene more interesting for investors and buyers.

Local Employment Statistics

St. George’s job market is booming, with many signs of a strong economy. The area is seeing big growth in different fields:

- Diverse job market with emerging technology and service industries

- Steady employment growth attracting skilled professionals

- Increased opportunities for remote workers

Population Growth Impact

The city’s growing population is changing the real estate scene. More people are moving in, looking for a good life and job chances.

| Population Metric | Current Data |

|---|---|

| Annual Population Growth | 4.2% |

| New Resident Demographics | Remote Workers, Retirees |

| Primary Migration Sources | California, Nevada, Utah |

Economic Development Projects

St. George is growing thanks to smart projects. Key efforts include:

- St. George Regional Airport expansion

- New technology park development

- Enhanced transportation infrastructure

“St. George represents a compelling blend of economic opportunity and lifestyle appeal for new residents and investors.” – Local Economic Development Council

These factors make St. George a promising environment for real estate. It shows the area is set for more growth in homes and businesses.

Investment Opportunities and Analysis

St. George is a great place for smart investors to look at in 2024. The median house price is $338,752, which is higher than the national average. This shows the market has a lot of promise for those who know how to invest.

Investors have many ways to make money in St. George:

- Long-term residential rentals

- Short-term vacation properties

- Fix-and-flip projects

- New construction investments

The market has different neighborhoods to choose from, each with its own appeal:

| Neighborhood | Investment Opportunity | Key Features |

|---|---|---|

| Washington Fields | High | Growing population, family-friendly |

| Little Valley | Promising | Stable property value appreciation |

| Downtown St. George | Urban Development | Cultural events, diverse dining |

Investors should keep an eye on trends like sustainable housing and smart home tech. The low vacancy rate in St. George shows there’s a strong demand for housing. This makes it a great place to invest in 2024.

“St. George’s real estate market offers a unique blend of growth and investment diversity.” – Local Real Estate Expert

For those looking at the St. George Market Forecast 2024, knowing the local scene is key. Picking the right neighborhood can help you make the most of your investment.

New Construction and Development Projects

The St. George housing market is looking bright for 2024 and beyond. Developers are bringing in new community designs that meet many housing needs.

Upcoming Residential Developments

Lennar, a well-known developer, is introducing La Spazio to St. George. This new community will offer:

- 98 new homes with different architectural styles

- Single-story and two-story home options

- Multigenerational Next Gen® suite integration

- Price range starting in the $600,000s

Commercial Project Impact

St. George is growing, showing its strong economic health. With a mix of healthcare, technology, and professional services, new projects will boost property values.

| Economic Sector | Growth Potencial |

|---|---|

| Healthcare | High |

| Technology | Moderate to High |

| Professional Services | Steady |

Infrastructure Improvements

St. George is investing in key infrastructure for growth. Improvements include:

- Enhanced transportation networks

- Expanded utilities infrastructure

- Advanced telecommunications systems

- Urban development aligned with the 2040 Downtown Plan

“St. George’s commitment to strategic growth makes it an attractive market for residential development.” – Urban Planning Expert

The city’s strong educational system, with Utah Tech University and Dixie Technical College, attracts new communities and buyers.

Market Comparison with Neighboring Cities

To understand Utah housing predictions, we must look at St. George property values compared to nearby cities. The real estate landscape in the region shows different market dynamics. These differences affect both buyers and investors.

St. George’s market stands strong when compared to other cities. Its housing market has unique traits that make it different from its neighbors.

| City | Price Change YoY | Market Stability |

|---|---|---|

| Washington | 0.0% | Stable |

| Saint George | -2.7% | Moderate Adjustment |

| Santa Clara | -6.7% | Significant Correction |

| Ivins | -7.1% | Notable Decline |

Looking at the regional market, we find some interesting trends:

- St. George has more stable property values than nearby cities

- Little change in prices shows a balanced market

- Regional economic factors help the market stay strong

*”Market comparisons provide critical context for understanding localized real estate dynamics”* – Regional Housing Analyst

St. George’s property values saw a small -2.7% drop year-over-year. This shows a controlled market. It points to the region’s economic strength and steady demand.

Investors and homebuyers can use these insights to make smart choices in Southern Utah.

Seller’s Market vs Buyer’s Market Analysis

The St. George housing market in 2024 is complex, with both sellers and buyers having their say. Recent data shows big changes that affect real estate trends in the area.

Key market indicators suggest a transitioning environment:

- Total active single-family property listings increased by 22.1% year-over-year

- Months of inventory expanded from 4.2 to 5 months

- Average sale prices continue to demonstrate steady growth

Sellers are seeing a moderate adjustment in the market. The sales to list price ratio fell from 98% to 95%. This means buyers have more room to negotiate.

| Market Metric | October 2024 Data | Year-over-Year Change |

|---|---|---|

| Average Sale Price | $589,632 | +8.31% |

| Total Properties Sold | 401 | +4.7% |

| Pending Contracts | 422 | +7.9% |

“The St. George real estate market in 2024 presents balanced opportunities for both buyers and sellers,” says local real estate expert.

Buyers can look forward to more options and a bit more power in negotiations. Sellers, though, will need to adjust their prices to draw in buyers, even with rising home values.

Professional Real Estate Services by Oak Real Estate

Understanding the St. George Market Forecast 2024 needs expert help. Oak Real Estate is here to help you make the most of real estate investments. We offer detailed services tailored to the local market.

Our Comprehensives Service Offerings

Oak Real Estate offers specialized support for those looking into real estate in St. George. Our services include:

- Home staging for the best market look

- New construction advice and support

- Property value and market analysis

- Help for buyers and sellers

- Guidance on investment properties

Expert Team of Real Estate Professionals

Our team is dedicated and knows the St. George market inside out. We help clients make smart choices.

“Success in real estate comes from understanding local market nuances and client needs.” – Oak Real Estate Leadership

Contact and Availability

Reach out to our team during our extended hours:

- Phone Numbers: (435) 640-7297 | (435) 879-9255

- Hours: Monday to Friday, 9:30 AM – 8:30 PM

- Location: St. George, Utah

If you’re looking into the St. George Market Forecast 2024 or real estate investments, Oak Real Estate is here to help. We offer the expertise and support you need.

Property Type Performance Analysis

The St. George housing market shows different trends for each property type. Each type has its own story of how the market is doing.

Our detailed look shows big differences in how properties perform based on the number of bedrooms:

| Bedroom Count | Median List Price | Price Change |

|---|---|---|

| 1 Bedroom | $280,000 | 0.0% |

| 2 Bedrooms | $350,000 | +6.1% |

| 3 Bedrooms | $475,000 | -5.5% |

| 4 Bedrooms | $651,400 | -1.5% |

| 5+ Bedrooms | $875,000 | 0.0% |

Key insights into St. George’s residential property projections include:

- 2-bedroom properties show the most growth

- 3 and 4-bedroom homes see slight price drops

- Larger homes keep their prices steady

“Understanding property type performance is key for smart real estate investments in St. George.” – Local Real Estate Expert

Potential buyers and investors should watch these trends closely. The residential property projections point to good opportunities in different property types.

Conclusion

The St. George housing market is complex for buyers and investors in 2024. Home values are expected to drop by -1% in December 2024. But, they might rise by 0.5% by September 2025. This shows a market that’s stable but has some growth.

Utah’s real estate scene helps keep St. George strong. The state’s average home value is $517,550, up 1.0% from last year. Homes sell quickly, in just 25 days, showing strong demand. Places like Eagle Mountain and Saratoga Springs are also promising.

Utah’s economy is doing well, thanks to tech, healthcare, and education. Low joblessness and a desire for suburban living boost real estate. Even with small market changes, St. George is a great place to buy a home.

Smart buyers should understand the market’s subtle changes. A little price adjustment means the market is maturing. Getting advice from local real estate pros can guide you well.

For more details, visit: https://oaksrealestateteam.com/st-george-home-sales-data/

For more details, visit: https://oaksrealestateteam.com/st-george-housing-inventory-analysis-2025-updates/

For more details, visit: https://oaksrealestateteam.com/property-evaluation/