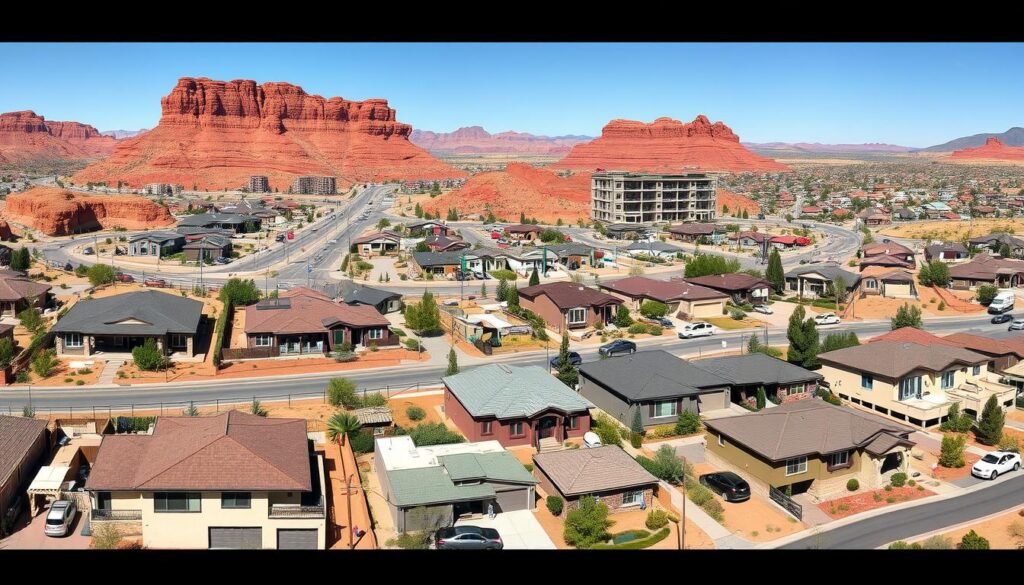

The St. George real estate market is strong and steady in 2025. It offers great chances for both buyers and sellers. In December 2024, home prices hit a median of $500,000, up 0.6% from last year.

Investors and homeowners are keeping a close eye on St. George’s real estate. It has shown great strength, bouncing back from the 2009 low. It’s ranked 6th among the top 10 markets ready to recover, showing its strong economy and good investment chances.

St. George has a good balance of homes for sale, with levels staying at one to two months. Interest rates are also low, making it a great time for real estate deals. The market is stable, with fewer defaults and distressed properties.

Key Takeaways

- Median home price in St. George reached $500,000 in December 2024

- Market ranks 6th in national recovery potential

- Low inventory levels create competitive market conditions

- Interest rates remain near historic lows

- Minimal foreclosure activity supports market stability

- Consistent sales growth ince 2009

- Attractive investment opportunities for buyers and sellers

Local St. George Housing Trends: Current Market Overview

The Utah Housing Market in St. George is showing changes in December 2024. Home prices and market activity are shifting. This creates a complex landscape for investors and homebuyers.

Here are some key insights on Home Prices in St. George:

- Median list price: $568,987

- Price decrease from November: -3.6% (-$21,012)

- Median price per square foot: $269

The local market shows variations across different neighborhoods:

| City | Price Change |

|---|---|

| Ivins | +9.9% |

| Washington | +1.7% |

| St. George | -3.6% |

| Santa Clara | -14.1% |

Housing inventory has grown, with 315 homes available in December 2024. This is an 11.3% increase from the month before. The market offers diverse opportunities for different property sizes.

“The St. George real estate market continues to evolve, showing promise for strategic investments,” say local real estate experts.

Bedroom-specific pricing shows small changes, with little movement in different home sizes. This suggests a stable yet changing Utah Housing Market environment.

St. George Real Estate Market Performance 2024-2025

The St. George housing market is showing both strength and complexity in 2024-2025. The St. George Housing Statistics show a detailed picture of price changes and market movements. These changes need close attention.

Recent data shows big changes in the local real estate scene. St. George Home Sales have been affected by many economic factors. This creates a complex market for both buyers and investors.

Median Home Price Analysis

In December 2024, the median home list price in St. George was $568,987. This is a 3.6% drop from the month before. This change shows efforts to stabilize the market and meet buyer needs.

Year-over-Year Price Changes

- Median price per square foot: $269

- Annual price fluctuation range: -1% to +1%

- Projected price decline by September 2025: -0.5%

Market Stability Indicators

| Metric | Value | Change |

|---|---|---|

| Home Sales Volume | 3,344 | +2.9% |

| Median Home Price | $508,005 | +4.1% |

| Days on Market | 25 | Stable |

“The St. George real estate market demonstrates remarkable adaptability in a changing economic landscape.” – Local Real Estate Analyst

Investors and homebuyers should watch these trends closely. It’s important to understand that local markets can differ a lot from state and national trends.

Property Inventory and Availability in St. George

The St. George residential properties market saw big changes in late 2024. In December, there were 315 homes for sale, up 11.3% from November. This shows the market is changing fast for buyers and investors.

Looking at the current market, we see some interesting trends:

- 2-Bedroom homes saw a 12.8% increase in availability

- 3-Bedroom properties experienced a 17.4% rise in inventory

- 4-Bedroom listings grew by 13.8%

- 5+ Bedroom homes increased by 2.6%

The average time a home stays on the market in Saint George is now 100 days. This is a 20.9% jump from last month. It might mean the market is slowing down a bit.

| Bedroom Type | Number of Homes | Month-over-Month Change |

|---|---|---|

| 1 Bedroom | 9 | 0.0% |

| 2 Bedrooms | 44 | +12.8% |

| 3 Bedrooms | 108 | +17.4% |

| 4 Bedrooms | 74 | +13.8% |

| 5+ Bedrooms | 80 | +2.6% |

“The expanding inventory provides more opportunities for buyers while maintaining a balanced market dynamic.” – Local Real Estate Analyst

Investors and homebuyers should keep an eye on these trends. They show chances in the St. George residential properties market.

Price Trends by Property Size

St. George’s housing market shows how property size affects prices. The local real estate scene is complex. It varies by property type and bedroom count.

Single Family Home Prices

Single family homes in St. George have interesting price trends. The median list price shows a market full of variations. Prices change based on bedroom count and location.

- 3 Bedrooms: Median price of $524,900

- 4 Bedrooms: Median price of $700,000

- 5+ Bedrooms: Median price of $950,000

Condominium Market Trends

The condominium market offers affordable options in St. George. Prices vary by size:

| Bedroom Count | Median Price | Monthly Change |

|---|---|---|

| 1 Bedroom | $209,000 | 0.0% |

| 2 Bedrooms | $324,500 | 0.0% |

Luxury Home Segment Analysis

The luxury home market in St. George is strong. Homes priced above $962,400 show little price change. This is despite market ups and downs.

The luxury segment remains a beacon of stability in the St. George housing landscape.

Investors and buyers should understand the complex price trends. These trends offer unique chances in St. George’s real estate market.

Days on Market Analysis and Sales Velocity

The St. George Home Sales market in 2024 is lively. It shows clear patterns in sales speed and how quickly the market reacts. These are important for both buyers and sellers to know.

Homes in St. George are on the market for about 45-52 days on average. This shows the market is balanced. Sellers can expect a fair amount of time to sell their homes.

“Understanding market timing is key to getting the most out of your real estate investment in St. George.”

St. George Housing Demand shows some interesting trends:

- March and April are the best months to list your home.

- Listing your home 4-8 days sooner than usual is possible.

- Listing at the right time can add up to 6.9% to your home’s price.

| Listing Month | Sales Velocity Impact | Price Performance |

|---|---|---|

| March | 4-5 days faster sale | +5.2% price increase |

| April | 6-8 days faster sale | +6.9% price increase |

| November | Standard market pace | +6.9% price increase |

Choosing the right time to sell can greatly affect your experience in the St. George real estate market.

Neighborhood Price Comparisons

The St. George Real Estate Market shows how different neighborhoods perform. This is key for those looking to buy or invest. It’s important to understand the local trends.

We’ve looked into what makes each neighborhood unique. We’ve found out how they behave in the market and their investment value.

Ivins Market Performance

Ivins stands out in the local housing scene. It has seen a +9.9% increase in median list price. This shows it’s a market with strong appeal and growth chances.

- Median list price growth outpacing regional averages

- Attractive investment opportunity for real estate buyers

- Consistent demand for homes

Washington Area Trends

The Washington area has a more steady market. It has seen a +1.7% increase in median list price. This shows a stable and balanced market.

“Stability is the hallmark of a mature real estate market” – Local Real Estate Expert

Santa Clara Housing Data

Santa Clara has a different market feel. It has seen a -14.1% drop in median list price. This might be a chance for smart buyers to find good deals.

| Neighborhood | Median List Price Change | Market Characteristic |

|---|---|---|

| Ivins | +9.9% | High Growth |

| Washington | +1.7% | Stable |

| Santa Clara | -14.1% | Buyer’s Opportunity |

These differences highlight the St. George Real Estate Market’s complexity. They show why it’s vital to do local research before making a decision.

Housing Affordability Index for St. George

The Utah Housing Market in St. George is complex. With a median home price of about $450,000 and a median household income of $80,000, affordability is a big issue. The Housing Affordability Index gives us important insights into the local real estate.

“Understanding housing affordability is key to making informed real estate decisions in St. George.”

Here are some key affordability metrics for St. George:

- Housing Affordability Index: 56%

- Median Home Price to Income Ratio: 6.26:1

- Year-over-Year Home Price Increase: 5%

- Average Days on Market: 30 days

St. George has a better affordability index than nearby cities like Ivins (48%) and Santa Clara (50%). The local market is strong, with a low foreclosure rate of 1.2%, much lower than the national average of 2.5%.

| Metric | St. George Value | National Comparison |

|---|---|---|

| Median Home Price | $450,000 | 16% Higher than Average |

| Household Income | $80,000 | Slightly Above National Median |

| Foreclosure Rate | 1.2% | Below 2.5% National Average |

First-time homebuyers are seeing more opportunities, making up 30% of all home purchases. The rental market is also interesting, with an average rent of $1,600 and a vacancy rate of just 4%.

Despite challenges, the St. George housing market is stable and promising for those exploring the Utah Housing Market.

Market Forecast and Future Projections

The St. George Real Estate Market is at a turning point, with growth on the horizon. Recent data shows a strong increase in housing demand. This is thanks to good economic signs and market trends.

Experts predict big changes in the St. George Housing Demand over the next two years. Key points include:

- Home prices expected to rise by 6.1% in 2024

- Projected price increase of 3% in 2025

- Inventory levels showing substantial growth

Growth Predictions

The St. George Real Estate Market is showing great strength. Fannie Mae’s forecasts show steady growth in property values. This shows the market is solid.

| Year | Price Growth | Market Trend |

|---|---|---|

| 2024 | 6.1% | Positive Growth |

| 2025 | 3% | Stable Appreciation |

Investment Opportunities

Strategic investors can capitalize on emerging trends in the St. George Housing Demand. The market offers chances in different property types:

- Short-term rental properties with 70-80% occupancy rates

- Residential properties in developing neighborhoods

- Potential for significant returns through effective property management

“The St. George real estate market offers exceptional opportunity for smart investors who understand local dynamics.” – Local Real Estate Expert

With inventory levels up and market conditions stable, now is a great time to look into investment options in the St. George Real Estate Market.

New Construction and Development Updates

St. George Residential Properties are going through a big change. The local housing market is growing fast. This is thanks to more people wanting homes and smart planning.

New projects are changing the look of Southern Utah. They are making the area more vibrant.

St. George Housing Supply is showing some exciting trends:

- Expansion of master-planned communities

- Introduction of energy-efficient home designs

- Focus on sustainable and affordable housing options

“The future of Saint George real estate lies in innovative, community-focused development,” says local urban planning expert.

The numbers show strong growth in new homes. The market is doing well. It has some key features:

| Development Metric | Current Status |

|---|---|

| Median Home Price | $415,000 |

| Average Construction Rate | 6% annual increase |

| Energy-Efficient Homes | Growing trend |

Oak Real Estate is ready to help with new construction. Potential homebuyers and investors can expect diverse options. This includes single-family homes and new community projects.

The area is getting more attractive. It has over 300 sunny days a year. Plus, a strong economy makes it perfect for growing homes.

Buyer and Seller Market Dynamics

The St. George housing market is both strong and complex. It attracts many buyers and sellers, shaping the local real estate scene.

It’s important to understand both buyers and sellers in the market. Recent data shows interesting trends in St. George Home Sales.

Buyer Demographics

St. George draws a wide range of home buyers. They include:

- Remote professionals looking for affordable homes

- Retirees who love the mild climate and views

- Young families for top-notch schools

- Investors interested in vacation and rental homes

Buyer Characteristics

| Buyer Type | Percentage | Average Purchase Price |

|---|---|---|

| First-Time Buyers | 35% | $425,000 |

| Relocation Professionals | 25% | $575,000 |

| Retirees | 20% | $495,000 |

| Investors | 20% | $650,000 |

Seller Strategies

Sellers in St. George are using smart strategies:

- Setting competitive prices based on market data

- Making small home improvements to boost value

- Using professional staging

- Marketing online

“The key to success in the St. George real estate market is understanding current dynamics and being adaptable,” says local real estate expert Emily Richardson.

Properties priced right from the start sell faster and closer to their original price.

Interest Rates and Mortgage Trends

The Utah Housing Market is seeing changes in interest rates and mortgage trends. These changes are affecting how affordable homes are in St. George. For those looking to buy or invest, understanding these shifts is key.

Interest rates for conventional loans are around 6%. This creates a tricky situation for the St. George real estate market. Buyers need to be careful with their financial decisions.

“Understanding mortgage trends is critical for making smart real estate choices in today’s market.” – Local Real Estate Expert

Important mortgage and interest rate trends include:

- Conventional loan rates are near 6% for those who qualify

- FHA loan rates are between 5.625% and 5.75%

- Median sales prices are seeing small changes

Homes in St. George are hard to afford, with prices around $529,000. Despite economic challenges, the market is holding strong.

| Loan Type | Current Rate | Market Impact |

|---|---|---|

| Conventional Loans | 6% | Moderate Buyer Accessibility |

| FHA Loans | 5.625% – 5.75% | More Options for First-Time Buyers |

Buyers should watch for interest rate changes after elections. These changes could greatly affect the market.

Oak Real Estate Services and Support

Exploring the St. George Real Estate Market needs expert help and full support. Oak Real Estate is here to change your property journey. We offer special services for different client needs in the local St. George Housing Trends.

Professional Home Staging

Our home staging experts know how important looks are in real estate. They create stories with visuals that:

- Make properties more appealing

- Show off special architectural details

- Connect with buyers on an emotional level

- Speed up the selling process

New Construction Services

Oak Real Estate helps with new construction projects. We guide clients through every step with care and skill.

| Service Category | Description |

|---|---|

| Site Selection | Strategic location analysis |

| Design Consultation | Architectural and aesthetic guidance |

| Permit Navigation | Streamlined regulatory compliance |

| Construction Oversight | Quality assurance and project management |

Contact Information and Hours

Our team is dedicated to top-notch real estate support. We’re available during convenient hours:

- Phone Numbers: (435) 640-7297 | (435) 879-9255

- Operating Hours: Monday to Friday, 9:30am to 8:30pm

“Your trusted partner in transforming real estate dreams into reality.”

Conclusion

The St. George Housing Market is showing great strength and promise. It’s attracting both investors and homebuyers. The area’s population has grown by 2.7% every year, with 5,625 new people moving in annually.

St. George’s real estate market is thriving. Home sales have gone up 7%, and prices have risen 11% to $310,900. The low vacancy rate of 1.6% shows there’s a high demand for homes.

The market is expected to keep growing. It’s predicted that the population will increase by 4.4% each year. This means more households and a strong economy.

If you’re thinking about buying or investing in St. George, get expert advice. Local experts can guide you through the market. They know the best neighborhoods and when to buy or sell.